marin county property tax rate 2021

The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

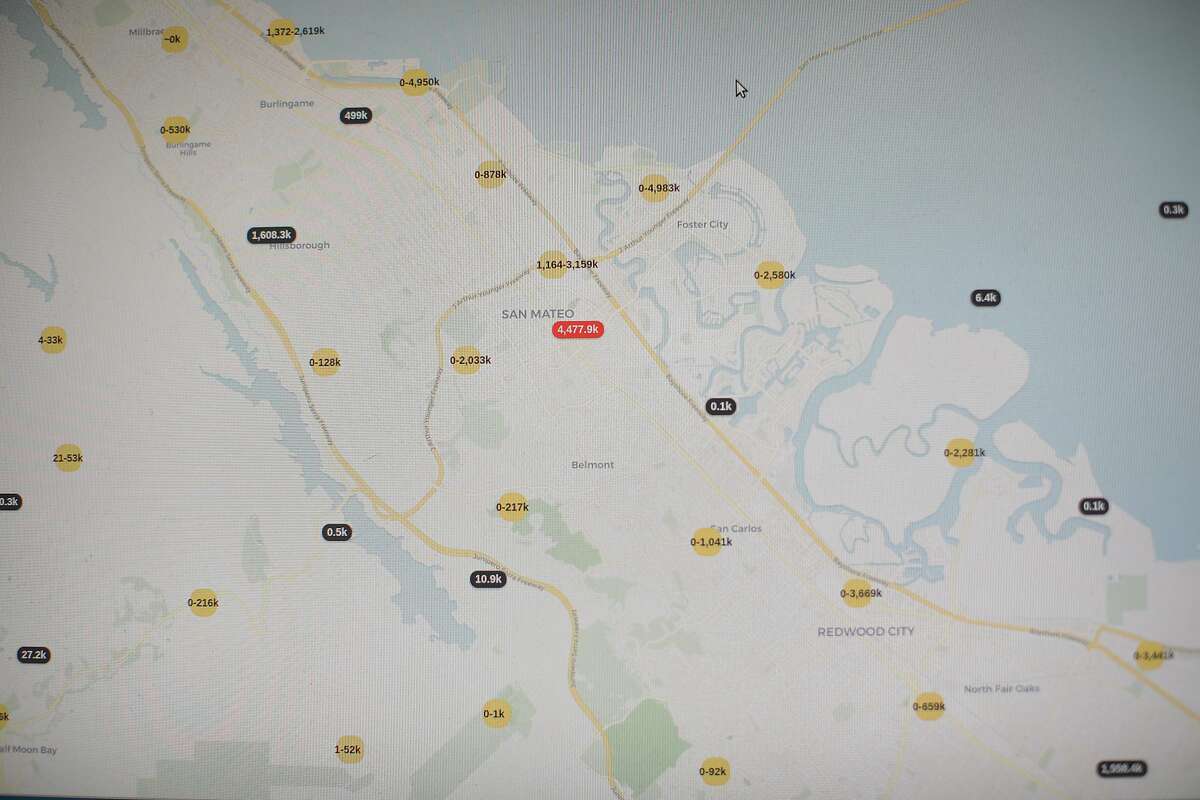

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over the previous year.

. California Revenue and Taxation Code Section 4083. In September the Marin County Department of Finance mailed 91854 property tax bills for the 2021-22 tax roll amounting to 126 billion. The Assessment Appeals Board hears appeals from.

Marin County collects on average 063 of a propertys assessed. Tax Rate Book 2020-2021. San Rafael CA Marin Countys 2021-22 property tax bills 91854 of them were mailed to property owners September 24.

Tax Rate Book 2017-2018. Tax Rate Book 2018-2019. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

Taxing District Millage Rate per 1000 of taxable value Total of all Millage Rates per 1000 of taxable value by Taxing District. 173198 View Millage Summary. This collection of links contains useful information about taxes and assessments and services available in the County of Marin.

This is the total of state and county sales tax rates. Property owners unable to pay their taxes by the deadline because of the pandemic may file a Request for Penalty Cancellation after the December 10 deadline. Tax Rate Areas Marin County 2022 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

Tax Rate Book 2021-2022. Marin County taxpayers are being asked to pay. San Rafael CA The first installment of the 2021-2022.

That was an increase of 319 over the. Box 4220 San Rafael CA 94913. This Board is governed by the rules and regulations of the Board of.

The Marin County sales tax rate is. San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm. The county mailed the.

The Assessment Appeals Board hears appeals from taxpayers on property assessments. The first installment of taxes is due November 1 second by April 20 2022. This years tax roll of 1262606363 is up.

The minimum combined 2022 sales tax rate for Marin County California is. The California state sales tax rate is currently. The following schedule lists some of the more significant dates for California property taxes affecting.

091 of home value Yearly median tax in Martin County The median property tax in Martin County Florida is 2315. Mina Martinovich Department of Finance. Tax Rate Book 2019-2020.

Marin County Tax Collector P. The median property tax in Marin County California is 5500 per. Martin County Florida Property Tax Go To Different County 231500 Avg.

Monday April 12 a date not expected to change due to the.

Proposition 19 Transfer Tax Base When Selling Your Home Faq Marin County And California

Where Your Property Tax Dollars Go Contra Costa County Ca Official Website

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

8 Things To Know About San Francisco Property Tax Rates Mike Plotkowski

2022 Property Taxes By State Report Propertyshark

California Property Tax Calculator Smartasset

Sonoma County Property Owners Rush To Transfer Inheritance Ahead Of New Prop 19 Rules Higher Taxes

Property Tax Bills On Their Way

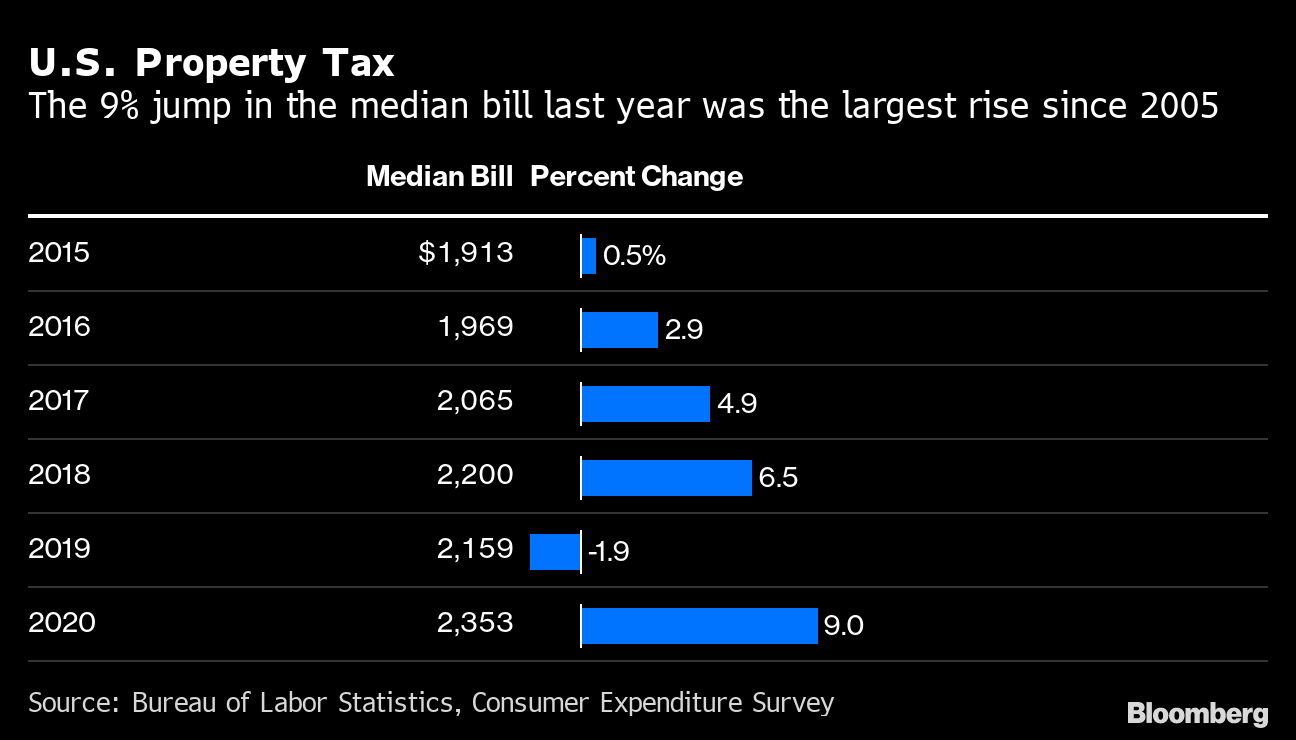

Historic Home Prices To Whack Owners In Next Year S Property Tax Bloomberg

Orange County Ca Property Tax Search And Records Propertyshark

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County California Wikipedia

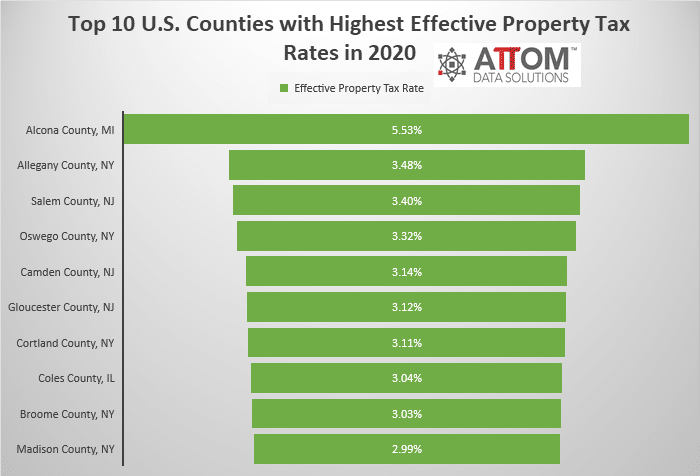

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers